Intragovernmental debt

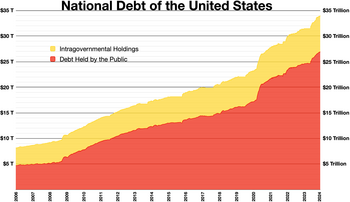

In public finance, intragovernmental holdings (also known as intragovernmental debt or intragovernmental obligations) are debt obligations that a government owes to its own agencies. These agencies may receive or spend money unevenly throughout the year, or receive it for payout at a future date, as in the case of a pension fund. Lending the excess funds to the government, typically on the accounts of its treasury, enables the government to calculate its net cash requirements over time.

United States

In the United States, intragovernmental holdings are primarily composed of the Medicare trust funds, the Social Security Trust Fund, and Federal Financing Bank securities. A small amount of marketable securities are held by government accounts.[1][2]

See also

US specific:

- United States public debt

- United States Treasury security

- Federal Financing Bank

- Bureau of Public Debt

- Federal Reserve System

- Office of Management and Budget (OMB)

References

- ^ "Frequently Asked Questions about the Public Debt". FAQ. U.S. Department of the Treasury, Bureau of the Public Debt. Archived from the original on January 9, 2008. Retrieved March 21, 2010.

- ^ "FRONTLINE: ten trillion and counting: defining the debt". Defining the debt. PBS. Retrieved March 21, 2010.

External links

- Treasury Direct

- Monthly Statement of the Public Debt (MSPD) and Downloadable Files, Treasury Direct

- Federal Financing Bank

- Factors Affecting Federal Reserve Balances, Federal Reserve statistical release

- Financial Management Service, A Bureau of the United States Department of the Treasury